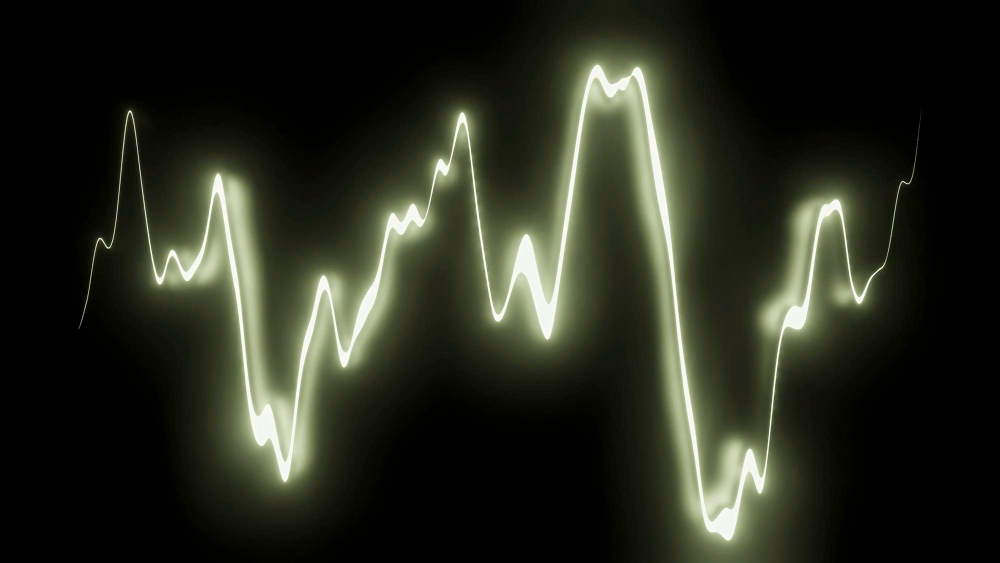

Elliot waves

Elliott Wave Theory is one of the most popular technical analysis tools in trading. Developed by Ralph Nelson Elliott in the 1930s, it is based on the idea that market prices follow predictable, recurring patterns, known as “waves.”

Principles of Elliott Wave Theory:

Impulse waves: They consist of five waves (1, 2, 3, 4, 5) that represent the main market trend.

-Corrective waves: They consist of three waves (A, B, C) that reflect the main market trend.

-Fibonacci ratio: It plays an important role in determining the lengths and ratios of waves.

-Wave patterns: There are many common patterns for impulse and corrective waves, such as triangles, zigzags, and channels.

Benefits of using Elliott Waves:

-Determining the market trend: It helps determine the current market direction, whether it is bullish or bearish.

-Determining entry and exit points: It is used to accurately determine the entry and exit points of trades.

-Understanding market behavior: It helps to better understand market behavior and anticipate its future movements.

Challenges of using Elliott Waves:

- -Self-interpretation: Interpreting wave patterns may be difficult and depends on the trader's experience.

- -Inaccuracy: Elliott Wave Theory does not guarantee 100% accuracy in predicting market movements.

- -Complexity: Elliott Wave Theory may be complicated for beginners.

- Tips for using Elliott Waves effectively:

- -Learn the basics: Make sure you fully understand the principles of Elliott Wave Theory.

- -Chart practice: Practice analyzing wave patterns on different charts.

- Use other analysis tools: Do not rely exclusively on Elliott Wave Theory.

- -Be patient: Do not expect immediate results, and be prepared to learn from your mistakes.